This might be a bit of a more weird blog post. I have been thinking about banks recently. I know exiting.

Banks are a bit of a fact of life for everyone. Everyone needs a bank. In fact, most companies here in Switzerland will not be able to pay you if you don’t have a bank account. There are more and more shops here as well that only accept payment by card1. And finally, everyone does need a place to safeguard their money2. But still, that begs the question, what kind of value do banks provide?

My requirements for safekeeping

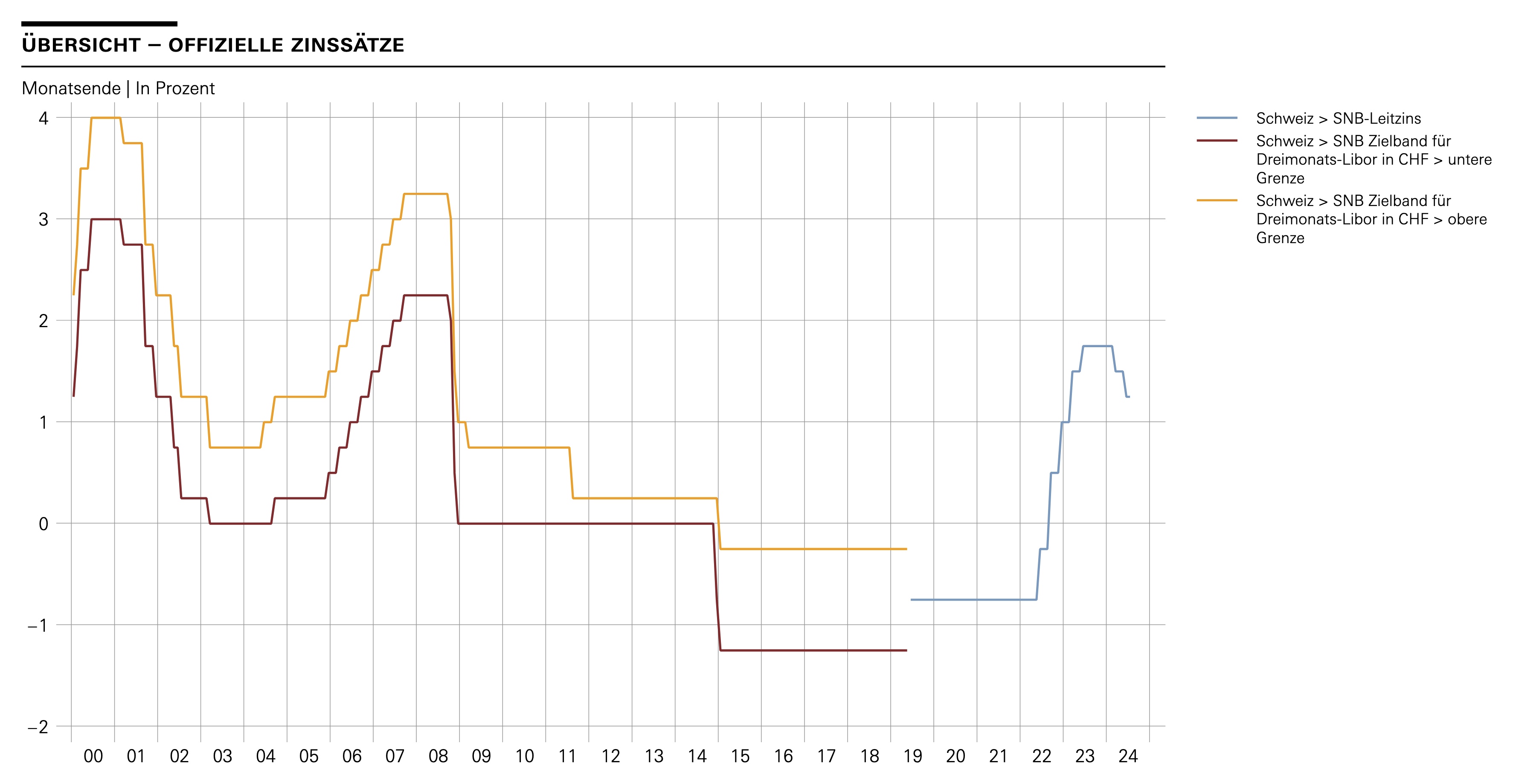

My money should be kept safe, and for that, I’m willing to pay a small percentage, that stands in relation with the current policy rate of the national bank. The current SNB policy rate is 1.25%, but different banks have rates anywhere from 0% to 1% for saving as well as non-savings accounts3. From this, I would say anywhere between 0.25% and 0.5% from the policy rate is probably acceptable. I generally don’t want to pay any monthly fees, although it might be a more just way than paying a percentage. But after all, having my money and getting a bit of interest on my money is not the only way banks make money.

Two banks right across from the house of parliament of Switzerland. There are two other major banks right nearby.

Switzerland is famous, not to say notorious, for its banks. We are a proud nation of bank users and overall, trust in banks is quite high in Switzerland. And funnily enough, people don’t like to change banks. Even if it means higher costs for them.

For a long time, this was not much of a worry for most people, as the higher cost was not in terms of money that people paid for their bank accounts, but simply lost interest rates. Some banks would have a bit higher interest rates, others would have a bit lower ones.

SNB policy rates from 2000, showing the drop below 0% around 2015. Source: SNB: Official interest rates

The problem arose when the policy rate dropped below 0% at some point. Banks would rather not charge negative interests to their customers, as this would have seemed like a very unpopular move. So banks instead started to charge monthly fees and keep the interest rates at 0%. And somehow behind the scenes they made it work. I assume that meant that people with less money were charged over proportionally, just as these things work out most of the time.

But I don’t really need any financial advisor service. I don’t have enough money for this to matter, and I’m quite capable (and sometimes even enjoy it) of figuring out what kind of financial products make sense for me, or which ones don’t4. I also don’t certainly have much need for banking places with a storefront. Not only that, but I have very limited use for ATMs as well. I only ever require them if I go abroad or to some other place that has absolutely not cards accepted.

So, for me, it is important the bank’s product work well, that means good e-banking and good mobile banking. I also care about being able to use them easily. The same, of course, goes for all the card products as well as savings accounts. I want to be able to use my credit card in the easiest imaginable way, and this includes usages such as Apple Pay and other convenient payment usages (maybe Garmin pay). I also think that banks generally should have good and sensible security procedures5.

So what kind of value do banks provide

So this does pose the question, how can banks provide this value in any sensible manner to me? And to be honest, I came to the conclusion that just about every bank can provide me with this, the different is mostly about their cost structure. And this is where I think most banks have a difficult value proposition, at least in my case. I know enough about how to handle my money, and I have quite a bit of difficulty seeing how banks provide some additional value to me.

As such, I have come to a rather simple conclusion. I will use the most convenient banks, with the best cost structures for me. And I will keep one of the legacy banks6, just in case, if the neobanks start to make more trouble than they are worth.

In my very non-scientific poll, I think the number of places accepting only cash still outnumbers the places that exclusively accept cards, but it’s getting much closer than before. ↩︎

I’m going to largely skip over safeguarding money. While this is an important function of banks, I have seldomly seen any bank advertise their safety. I also do feel like the post office or a large supermarket chain might be just as good at safeguarding money than any bank. ↩︎

This analysis was done by me rather quickly, so there might be other offers as well. I was looking at bank accounts that have no fees and include savings and non-savings accounts. ↩︎

Last time I did one of this advisor things with one of the big banks in Switzerland, the banker had to admit, that my current setup (combination of bank accounts, debit, and credit cards and retirement savings) is better than anything they could offer me. ↩︎

As someone with a bit of a background in security through my studies, it always amazed me when a bank tries to authenticate me on the phone by asking from my birthdate or my address. This is not secure information and will not authenticate me. ↩︎

By legacy bank, I mean one of the big traditional brick and mortar banks in Switzerland. ↩︎